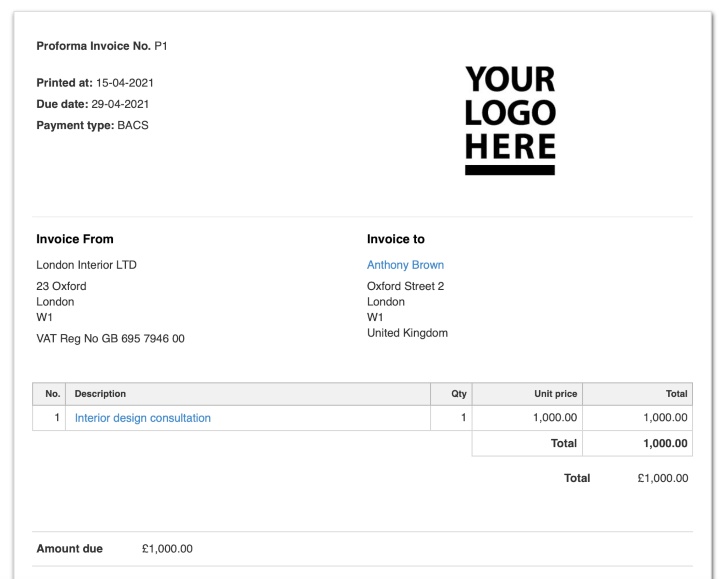

You’ve established your company and sold items or services to clients and consumers. This required sending an invoice to them in the process. But how do you draft an invoice?

Even if you’ve been managing a company for a while, you might think about any additional or new information you need to put in. While the best recommendation is to use an invoice template, we provide some important information for UK businesses to keep in mind.

What Exactly is an Invoice?

It is futile to talk about what constitutes a good invoice without discussing what an invoice is first. An invoice is a payment request. It reflects what your consumer owes you in exchange for the items or services you provided. Also, the full-time employees within the public sector processes 43,000 online invoices each year.

Your invoices are tax papers as well. You must maintain copies to prove how much money you made and – if you’re VAT registered – how much tax you collected for the government.

Pay Extra Attention to Details

Your free invoice template in the UK must be accurate if you want them to be paid on time and without the need for additional assistance. When clients demand missing data to process invoices successfully, there’s a strong chance they will delay your payment until the issue is resolved.

It’s critical to have consistent, up-to-date data across all of your platforms, which is why using an invoice template software may help. Your automatic system would flag these types of concerns.

Government Requirements

The UK government mandates the following information be included in every invoice:

- A unique serial number

- Your company’s name, address, and phone number

- The relevant details of the customer you’re billing

- A detailed description of the service you’re charging for

- The supply date.

- The invoice’s due date

- The amount that will be charged

- If applicable, the VAT amount.

- The total sum that must be paid

VAT

VAT, or Value Added Tax, is a company tax imposed by the government on selling goods and services in the United Kingdom. All firms with yearly sales over the current VAT threshold must register for VAT and file a VAT return.

VAT Invoices

If you’re managing a business in the UK, this is an important point. Something many people often overlook.

- To charge VAT on sales or reclaim VAT paid on goods or services purchased, you must have a valid VAT invoice.

- A VAT invoice has all of the VAT information that HMRC demands. VAT-registered firms can only issue VAT invoices.

- If your company is VAT-registered, you’ll need a full VAT invoice in most circumstances, but for some retail transactions, a modified or simplified invoice should suffice.

There is currently, 5.7 million businesses within the UK. But starting and maintaining a business in the UK is an arduous task. With a growing market for small businesses and an uncertain political climate, minor things like invoices have to be re-evaluated. Try to ease your burdens when you can.

That is why we recommend a free invoice template for UK businesses. That way, you don’t need to check the news every day for the changing policies while running your business.

to check the news every day for the changing policies while running your business.