A 23-year-old man, Myles, has faced criticism from mainstream media (Yahoo Finance and Daily Mail) after he admitted to depleting his $30,000 savings and accumulating over $9,000 in credit card debt, all due to his partying habits. Despite this, he insists on working no more than 15 hours a week, citing his dedication to teaching jiu-jitsu and training as the reason.

Originally from Pennsylvania, Myles, a field auditor now based in Austin, Texas, experienced a drastic change in his financial situation. He previously worked in construction, earning between $10,000 and $12,000 a month. However, after relocating to Austin for a new project that fell through, he found himself earning significantly less

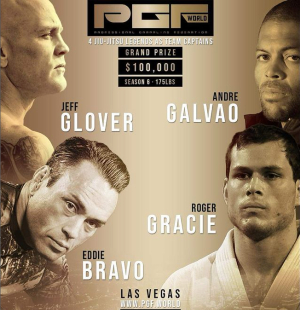

Myles, who trains extensively at Renzo Gracie Austin, shows less enthusiasm for his actual job. He does offer coaching at RGA, leading a wrestling class once a week, but this contributes little financially.

He mentioned that he doesn’t pay for jiu-jitsu training as he compensates by teaching classes, effectively covering his monthly membership fee of about $325. It’s notable that infections at the gym are apparently so frequent that he included antibiotics in his new budget plan. This situation might explain why Gordon Ryan is having difficulty healing his stomach issues.

Myles’ financial situation even caught the attention of Yahoo Finance, which highlighted his past excessive spending habits and current reluctance to work more than 15 hours a week to resolve his debt.

Despite training potentially under renowned coach John Danaher, Myles seems to be unaware of the limited financial prospects in the world of Brazilian Jiu-Jitsu.

His financial woes were highlighted in an episode of “Financial Audit With Caleb Hammer” on YouTube. Caleb, the financial expert, expressed shock and frustration at Myles’ unwillingness to increase his work hours to address his debt. He called Myles immature and compared him unfavorably to others who work much longer hours yet still struggle financially.

Myles justified his limited work hours by claiming that a busier schedule would not make him happy. Caleb, however, pointed out that Myles was using his time for fun, mainly spending his money on food and leisure activities.

Despite Caleb’s urging to get a second job, Myles initially refused. However, after some discussion, they devised a plan to help Myles clear his debt in five years if he increased his work hours. By the end of their conversation, Myles agreed to work at least 30 hours a week.

This story highlights the broader financial struggles many face, with some people resorting to living in cars or vans due to inflation, while others still struggle to make ends meet despite earning a six-figure salary.