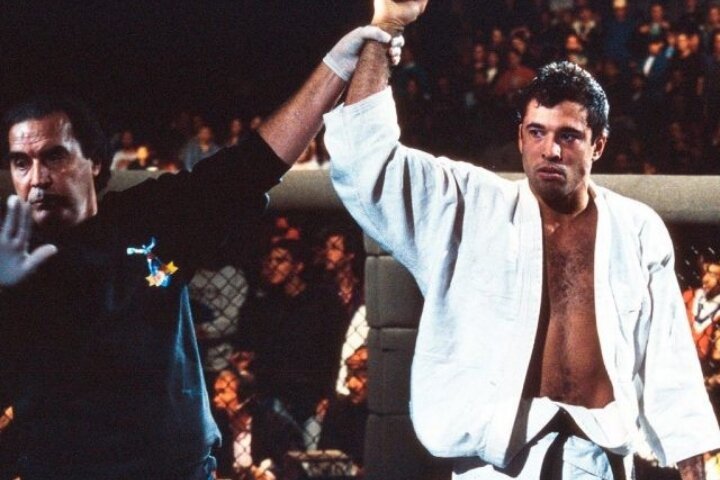

UFC and Brazilian Jiu-Jitsu legend Royce Gracie had a seven-year-long battle with the Internal Revenue Service (IRS) – and has now forced the IRS to “tap out”.

The IRS claimed that Royce did not pay taxes in 2007 or 2012, even though he owned a number of BJJ academies across the United States.

Additionally, it appears that he also received money from the government via the so-called “Earned Income and Child Tax Credits”.

The IRS decided to slap Royce and his corporation with tax liabilities – totaling $1,962,222.25 USD.

Now, after seven years of going back-and-forth with the IRS, as well as three lawsuits against the Commissioner of the IRS and numerous extensions, the IRS has settled with Royce for a fraction of the original tax liabilities.

According to Forbes, Gracie’s personal tax liability for 2007-2012 was reduced from $657,114 to $355,086.

The inital 75% fraud penalty was reduced to 30%, which meant that the total for the five-year period is now $461,611.80.

As far as Royce’s corporation is concerned, Royce was charged $85,146, alongside with a 20% accuracy-related understatement penalty.

Altogether, Royce Gracie will pay a total of $563,787; which is roughly a quarter of what the IRS was originally seeking.

View this post on Instagram