Written by Brearin Land, BJJ Black Belt and instructor at Gracie Barra HQ in Irvine. He is also the CEO of a wealth management firm Irvine Wealth, and is specialised in Retirement Income Planning. Check out his FB Page and blog Black Belt Of Finance .

Tell me something.. Would you go into a tournament without a strategy? No, of course not. Successful athletes go into battle with not only a strategy for themselves but also one that changes based on the opponent they are up against.

And would you prepare for a major tournament by simply practicing technique alone? No way, you’d be looking to stress test the techniques you are working on against every possible scenario in sparring and push yourself to the limit.

You may say that making these kind of mistakes would be setting an athlete up for failure and you’d be correct, but why then do investors take these kind of approaches everyday to their retirement plans?

Brearin Land

One of the most common themes I see among my clients who are still in the accumulation phase of their wealth building is that they are simply going through the motions with their saving without any type of efficiency.

If you are going up against a guy like Keenan Cornelius, you had better be prepared. He is going to come with a style that if you are not aware of or prepared for, is going to allow him to have a competitive advantage.

Likewise, if you were going up against a guy like Lucas Leite that would be a completely different scenario that you’d have to be prepared for. If you allowed him to play half guard you are almost surely going to get swept.

Each and every competitor brings with them a unique game and skillset that you have to be prepared for, but if you were to isolate the major opponents and were able to focus on shutting down their best positions you would give yourself a much better shot at success.

This is the same mindset you need to be taking with your retirement planning. Preparing for retirement is like preparing for the tournament of your life. Luckily I have outlined the three major competitors to your retirement plan that if prepared for will leave you well on your way to a stress free retirement.

Fernando Terere

2x World Champion

Jiu-Jitsu Legend

BBOF: You have been in some amazing battles. Leading up to those big matches how did you strategize for the different opponents you went up against?

TERERE: “I analyzed my adversaries and always went [for their weakness]. When I saw that they fought on bottom, I pulled him first into guard and when I saw that they were playing on top I tried to [go for takedown]. I think a competitive athlete has to be complete to be always sure where to fall.”

Check out Terere’s Academy and support his kid’s project at:

http://tererebjj.blogspot.com/

Opponent #1: TAXES

In the accumulation phase of a retirement plan you may have a tendency to focus the majority of your attention on returns, but it is mitigating against the loss of your money that is what the wealthy do differently. One of the most surefire ways of keeping more of your money in retirement goes beyond investment returns and falls on having an efficient tax strategy.

Having an efficient tax strategy means having each of your individual investments placed in the proper investment vehicles so that you are not unnecessarily taxed.

Without even knowing it is happening, tax inefficiencies are actually very common among investors and something you want to address sooner rather than later. A great example.. one of the parent’s of a student I teach came in for a Portfolio Stress Test. She had an IRA that was managed by another firm in the area but she admitted that she really just allocates a portion of her earnings to the account and doesn’t really know much about what is in it.

One of the issues we found in the stress test was a common mistake made within qualified accounts. She was placing tax-exempt investments (municipal bonds) inside of a tax-deferred vehicle (her IRA).

In this scenario there are a couple reasons why this is big mistake:

The benefit of an IRA is not having to pay taxes until a withdrawal is made, but with a tax-exempt investment you would be exempt from paying taxes on this interest regardless.

Since this bond is tax-exempt and being put inside a tax-deferred vehicle the benefit of the bond is negated. As a result she was over-paying to get a yield that was lower than could have been found with a taxable bond.

Thankfully we were able to catch this early on while she still had plenty of years left to accumulate wealth efficiently. This is just one example of using a tax efficiency strategy to keep more the returns you’ve made. Consult a financial advisor to see how you can improve the efficiency of your portfolio, or take a Portfolio Stress Test today.

To leave you with a good nugget of wisdom just remember that generally speaking, putting tax-efficient investments should be placed inside of taxable accounts, and investments which are not tax efficient should be made inside of tax exempt or deferred investment vehicles.

Felipe Costa

Felipe Costa

BJJ World Champion

9x World Medalistfelipe_costa

Check out the all the free videos and content at Felipe’s stie:

BrazilianBlackBelt.com

BBOF: You have been in some amazing battles. Leading up to those big matches how did you strategize for the different opponents you went up against?

FELIPE: “We often get worried when we are going to face top competitors, especially in a BJJ tournament where you fight several times in the same day against opponents who may have completely different styles.

Sometimes they are more aggressive, maybe defensive, etc. I have come to the conclusion that you have to focus on your strong points more than how to fight against the strong points of your opponent.

Knowing his style and being prepared to face it is important, but what works better for me is to try and take the lead of the fight an impose my own style.

If it happens that my best effort is not enough to beat my challenger, it means I need to prepare more, but it appears that most of the times, when I manage to concentrate on that aspect, the results come out well.”

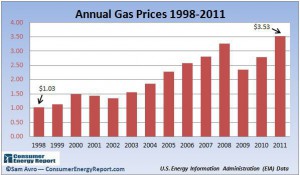

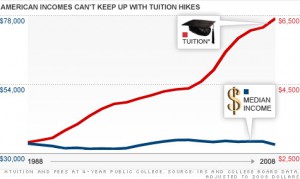

Opponent #2: INFLATION

“Remember when we could buy a uniform for $150?!” – Our Jiu-Jitsu kids 20 years from now.

We have all felt the sting of inflation in one way or another.

Within just this past generation we’ve been hit pretty hard.

Take a look at the price of gas:

Or the price of groceries:

https://research.stlouisfed.org/fred2/graph/?g=8l2

Or worse yet, college education:

http://money.cnn.com/2011/06/13/news/economy/college_tuition_middle_class/

How Inflation Affects a Financial Plan

Each and every client is unique in their retirement and lifestyle goals. Likewise, each of them have a different appetite for risk. I recently met with a millennial couple who was terrified of the stock market. The wife said “My parent’s lost nearly all their money in 2008. I would rather bury my money in the backyard than invest in the stock market.”

Stock market volatility is a valid concern for any investor. What happened to her parent’s happened to close family of mine as well, but the truth is, not everyone lost money in 2008. Poor investment choices, not following their time horizons for liquidity, and having no downside protection led to the deep losses felt in 2008. Then the broad sell-off of these losses further solidified these poor decisions.

I didn’t get into all this with the couple. I simply told them that taking the approach to stay out of the market is fine but doing so can be just as risky. I told them that staying out of the market will ensure that financial Armageddon will not take place overnight, but that leaving your money in cash can be a much slower and painful financial disaster.

When it comes to investors with a long time horizon like my millennial friends, the inflationary risk brought on by investing exclusively in low yielding investments like cash, CDs, treasury bills, and bonds is even more dangerous to building long term wealth than investing in equities [1].

Keep this in mind as you build out a strategy for retirement. Don’t focus on a simple monetary goal like “I want to retire with a million dollars,” because a million dollars in 20 years will likely not have anywhere near the same amount of buying power that it does today.

Murilo Bustamante

Murilo Bustamante

Former UFC Middleweight Champion

BJJ World ChampionMurilo-bustamante

Make sure to follow Professor Murilo on Instragram:

@MuriloBusta

BBOF: You have been in some amazing battles. Leading up to those big matches how did you strategize for the different opponents you went up against?

MURILO: Every time I fought I [would] prepare myself in the hardest way possible. I made my sparring time hard in all divisions I trained: BJJ, boxing, wrestling and then MMA.

Then I felt myself confident to fight anywhere during the battle. On the feet or on the ground. Of course my first strategy was always to be unpredictable.

It was possible because of my solid striking and ground game. I tried to never let my opponent know what I was wanting to do.

Of course my goal was to be on the ground because of my BJJ background. Then I used my boxing to make my opponents confused before I’d take them down.

Or tease them to make them try to punch me then it made the take down easier for me. The word for my strategy was to be unpredictable.

Opponent #3: MUTUAL FUNDS

Have you ever heard the expression “the most dangerous punch is the one you don’t see coming?” Those are the punches that leave you on the ground wondering what the heck just happened.

This is why mutual funds may just be the most dangerous opponent to your retirement plan. Everyone knows taxes and inflation suck, but mutual funds on the other hand are like a bully that doesn’t have the heart to pick a fight with you, they just sucker punch you when you’re not looking.

The problem with mutual funds is that by nature they are extremely high in fees. What’s more is that these funds are not required to disclose all of their fees so you are left with a banged up portfolio and no idea what hit you.

http://www.demos.org/data-byte/mutual-fund-fees

While fees are definitely a reason that mutual fund performance is being weighed down, the truth is that mutual funds just do not perform very well to begin with. Less than 1% of mutual fund managers actually beat the market with any kind of superior stock picking or market timing [2].

Unfortunately many of those who are allocating the majority of their money into a employer sponsored retirement account (such as a 401k) don’t have many other options. In the near future we may see more inexpensive ways to invest inside of these retirement accounts (ETFs for example) but for now what investors are stuck with are about as efficient as a white belt playing open guard.

You will want to chat with a financial advisor to make sure you are managing your retirement account efficiently. What I do with my clients is simply give them re-allocation recommendations during our review meetings.

In any event, due to the limited options within these employer sponsored accounts, as well as their high fees you may want to just take advantage of the company match and then work toward maxing out a Roth IRA.

As always, it was a pleasure and please if you have any questions just shoot me a comment below or you can always go to IrvineWealth.com and request a discovery call. I’m all about paying it forward and helping out the BJJ community so if you have a simple question you can assure you’ll get an answer with no sales pitch required.

1. http://www.brightscope.com/financial-planning/advice/article/5777/Inflation-Sucks/

2. http://www.marketwatch.com/story/almost-no-one-can-beat-the-market-2013-10-25